UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ¨

Filed by a Party other than the Registrant x

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 14a-12 |

CytoDyn Inc.

(Name of Registrant as Specified in Its Charter)

PAUL A. ROSENBAUM

JEFFREY PAUL BEATY

ARTHUR L. WILMES

THOMAS J. ERRICO, M.D.

BRUCE PATTERSON, M.D.

PETER STAATS, M.D., MBA

MELISSA YEAGER

CCTV PROXY GROUP, LLC

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials: |

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

The participants named herein (collectively, the “Participants”), have filed a definitive proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of its slate of director nominees at the 2021 annual meeting of stockholders of CytoDyn Inc., a Delaware corporation (the “Company”).

On September 2, 2021, the Participants sent a letter to the Company’s stockholders (the “Stockholder Letter”) and posted the Stockholder Letter to their website, www.advancingll.com. A copy of the Stockholder Letter is filed as Exhibit 1 hereto. Also on September 2, 2021, the Participants issued a press release announcing that they had sent the Stockholder Letter and detailing some of its contents. The press release contained a link to the Stockholder Letter. A copy of the press release is filed as Exhibit 2 hereto. The Participants also e-mailed links to the Stockholder Letter and the Press Release to certain of the Company’s Stockholders. A copy of the e-mail is filed herewith as Exhibit 3.

Exhibit 1—Stockholder Letter Dated September 2, 2021

Dear Fellow CytoDyn Stockholders,

We are a group of CytoDyn (“CYDY” or the “Company”) stockholders (collectively the “Group” or the “Nominating Stockholders”) who invested in the Company because we believe in the power of Leronlimab, a revolutionary drug with the potential to improve and save thousands of lives and generate significant long-term value. Unfortunately, CYDY’s current Board of Directors and management team has a long track record of mismanagement and poor execution that has resulted in numerous failures and value destruction.

Most notably, since 2013, the CYDY management team and Board has consistently failed to secure FDA approval for Leronlimab.

In an effort to reinvigorate CYDY, we have nominated five highly experienced candidates – Thomas Errico, MD, Bruce Patterson, MD, Paul Rosenbaum, Peter Staats, MD, MBA and Melissa Yeager, JD – to serve you on the Company’s Board of Directors. Our nominees have developed a comprehensive strategic plan for CYDY, designed to obtain FDA approval for Leronlimab. In the near future, we will share the details of this plan, which includes:

| · | An organized, deliberate strategy for long-haul trials that is ready to be shared with the FDA; |

| · | A strategy to overcome current management’s failures to quickly and effectively complete the necessary trials and applications to receive FDA approval for Leronlimab as an HIV therapy; and |

| · | Targeted partnerships with oncology companies lacking a CCR5 asset that can benefit from Leronlimab. |

Upon implementation, we believe that this plan will immediately begin to generate much-needed revenue for CYDY, and we look forward to outlining it in further detail shortly. In the meantime, we urge stockholders to vote the WHITE proxy card today to elect our five independent director nominees to effect sorely needed change on the CYDY Board.

CHANGE AT THE BOARD LEVEL IS NEEDED NOW

Over the last several years, we have exhausted other avenues to work constructively with the Board and management team to repair CYDY and help secure FDA approval for Leronlimab; they have refused to meaningfully engage with us every step of the way. In fact, we contacted the Board directly on no less than five documented occasions in an effort to assist the Company in enhancing its standing in the marketplace and with the FDA, only to be ignored each time. Instead, they have repeatedly conducted poorly-designed, poorly-executed trials that have failed to meet their primary endpoints and that we believe have damaged CYDY’s relationship with the FDA, which is imperative to the Company’s future.

Moreover, we believe management, together with the Board, have manipulated the Company’s corporate machinery in an attempt to further their own positions and compensation. Specifically, they have rewarded themselves with outrageous compensation packages compared to normative industry standards, despite the fact that net losses incurred during 2019, 2020, and 2021 fiscal years were approximately $56.2 million, $124.4 million, and $154.7 million, respectively.

To make matters worse, the Company disclosed in its annual report on July 30, 2021 that it is being investigated by both the Securities and Exchange Commission and Department of Justice “regarding the use of Leronlimab as a potential treatment for COVID-19 and related communications with the FDA, investors, and others, and trading in the securities of CytoDyn.”1

The detailed history of our engagement and the Company’s missteps is disclosed in the definitive proxy statement which was recently filed with the SEC and we encourage all stockholders to read it carefully.

We believe that with the right Board and management team, CYDY can restore credibility among the regulatory, medical and investment communities to realize Leronlimab’s full medical and commercial potential.

Our nominees bring extensive and proven leadership experience, and extensive knowledge of medical regulatory affairs. They have the skill sets, backbone, and necessary FDA relationships required to recruit a world-class management team, stabilize Leronlimab development efforts, and obtain U.S. and international approval for the drug.

Simply put, these nominees give CYDY its best chance of turning the Company around and enhancing stockholder value before it is simply too late.

CYDY’S CURRENT BOARD AND MANAGEMENT HAVE PUT THE VALUE OF YOUR INVESTMENT IN JEOPARDY DUE TO THEIR PERSISTENT TRACK RECORD OF FAILURES AND MISTEPS

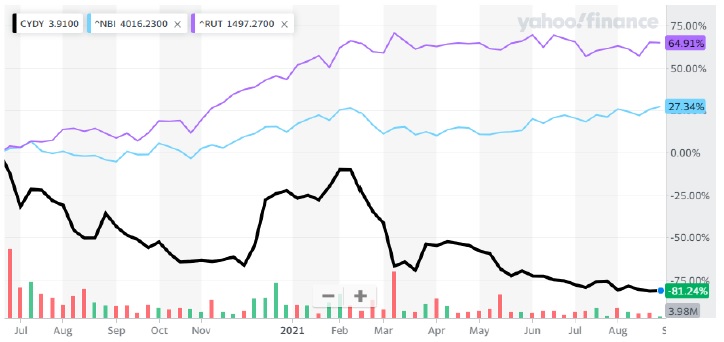

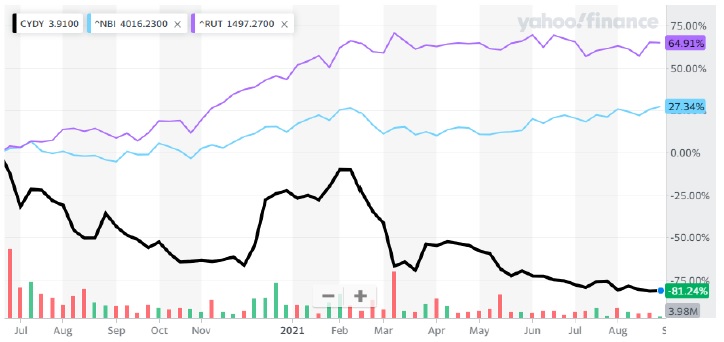

CYDY’s leadership has abjectly failed to exert sufficient operational and regulatory oversight, leading to significant value destruction that must be addressed immediately. Since CYDY’s stock price reached an all-time high of $10.01 on June 30, 2020, the Company’s shares have lost more than 81% of their value while the Nasdaq Biotechnology Index has increased more than 27% and the Russell 2000 has increased nearly 65%2.

1 CytoDyn, Inc. (2021). 2021 10-K Form.

2 As of market close on September 1, 2021

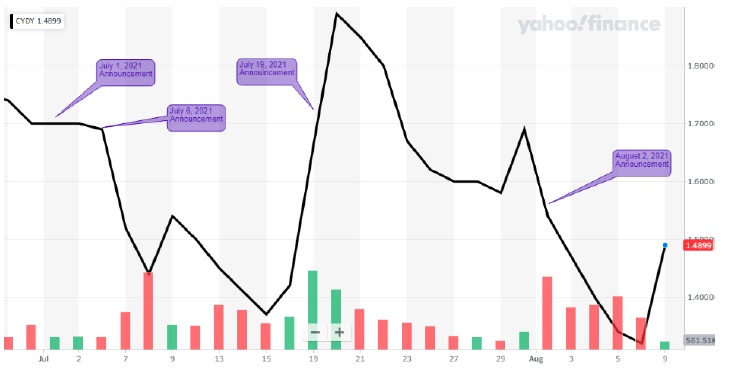

After we announced our intentions to effect necessary change at CYDY on July 1, 2021, when the stock price was at $1.70, the current Board and management team began initiating a misguided public relations campaign designed to distract you from its history of failures and missed deadlines. This campaign has consisted of a series of seemingly positive announcements, apparently intended to have a favorable impact on the Company’s stock price.

However, these announcements were nothing more than an artificially manufactured narrative designed to obscure the fact that CYDY has made virtually no progress in addressing the significant managerial and operational deficiencies that have resulted in regulatory delays and destroyed stockholder value. In fact, the developments recently announced by CYDY do not in any way advance the Company’s efforts to secure FDA approval for Leronlimab. The markets understood this deceptive narrative as well and responded accordingly:

| · | July 1, 2021: |

| o | Announcement: CYDY announced that it submitted a dose justification report to the FDA to overcome deficiencies in its Biologics License Application (BLA) for HIV. |

| o | Facts: Current CEO Dr. Nader Pourhassan told the Portland Business Journal in 2019 that CYDY “would file the full [BLA] application by the end of 2019 and would have revenue in 2020.”3 However, the Company did not file all remaining parts of its BLA until May 2020, and this release is just the latest example of the lengths the current management team will go to cover up its previous scientific mismanagement. Pourhassan further stated in a video dated August 16, 2021 that the BLA is “hopefully back on track” and that he hopes to have the resubmission completed this year. Pourhassan did not commit to a submission by the previously stated target date of October 15, 2021, calling into question management’s competency to complete an appropriate BLA filing.4 |

| o | Stock Price: Stayed flat (though the Company released an update regarding the FDA response to this report on August 13, and the stock price dropped nearly 13% over the next three trading days). |

| · | July 6, 2021: |

| o | Announcement: CYDY announced that Leronlimab has been granted a patent from the U.S. Patent and Trademark Office for methods of treating COVID-19. |

| o | Facts: CYDY management announced the introduction of biomarkers, key measurable indicators, in the analysis of Covid-19 clinical trials on a June 15 conference call. This came after the patent was submitted in Spring 2020, indicating that management filed the patent using another company’s biomarker technology. What the Company failed to mention is that the biomarker data was based upon test kits and analysis developed by Dr. Bruce Patterson (one of the Group’s nominees and among the foremost experts in COVID-19 biomarker testing), who was critically involved in the inventive process of these patents. To maximize the patents’ financial potential, Dr Patterson’s cooperation and involvement is crucial. Dr. Patterson has tried to work with current management time and time again, only to be rebuffed. This is peculiar given that without Dr. Patterson’s collaboration, the clinical trial process likely wouldn’t be able to move forward. |

3 Hayes, E. (2019, March 14). CytoDyn hits the home stretch for HIV therapy to hit the marketplace. Portland Business Journal.

4 Gunnion, S. (2021, August 16). CytoDyn receives FDA guidance for its HIV biologics license application dose justification report. Proactive Investors.

| o | Stock Price: The stock price dropped more than 14% in the two days following the announcement. |

| · | July 19, 2021: |

| o | Announcement: CYDY announced that its clinical trial with Leronlimab in combination with carboplatin for the treatment of metastatic breast cancer advanced from Phase 1b to a Phase 2 trial and received strong results in both trials. |

| o | Facts: While CYDY went out of its way to make the results of the trial sound impressive, their scientific legitimacy is questionable at best. This was an open label trial with no masking, patients were not randomly assigned, and there was no control group involved. As such, the Company inappropriately compared the results to statistics of survival for a general population of metastatic breast cancer patients. Without an actual clinical trial showing statistical significance, further progress will be difficult to obtain. |

| o | Stock Price: The stock price dropped almost 5% in the seven trading days following the announcement. |

| · | August 2, 2021: |

| o | Announcement: CYDY attempted to invalidate our director nominations by saying that our Nomination Notice Letter failed to meet the Company’s bylaws and contained deficiencies. |

| o | Facts: This is yet another desperate action to further disenfranchise shareholders and entrench a board and management team that have overseen repeated operational failures and a dramatic share price decline over recent months. In fact, CYDY management misinterpreted the provisions of their own bylaws and have no legal basis for rejecting our director nominations. Furthermore, the Company hired very expensive lawyers to wage a very expensive court battle at a time when CYDY is incurring extensive losses and struggling financially, demonstrating a clear misuse of company funds and continued value destruction just to prevent stockholders from even having the chance to vote on our slate. |

| o | Stock Price: The stock price dropped over 13% in the four trading days following the announcement. |

The markets have caught on to the fact that none of these so-called developments have anything to do with advancing FDA approval for Leronlimab and are simply intended to manipulate and deceive. Stockholders deserve better.

OUR DIRECTOR NOMINEES HAVE THE RIGHT PLAN TO RESTORE CYDY’S CREDIBILITY AND GENERATE LONG-TERM VALUE FOR ALL STAKEHOLDERS

Our five nominees are among the most respected leaders in the relevant fields of medicine, regulatory oversight, and corporate finance and possess extensive executive and board experience. They would bring critical independent perspectives and deeply relevant experience that is currently missing from the Board and would position CYDY to thrive and deliver vastly improved stockholder value. Their qualifications are exactly what CYDY needs if it is to obtain FDA approval for Leronlimab and maximize your investment:

| · | Dr. Errico is a world-class surgeon and FDA consultant. Over the course of his three decades-long career as Associate Director of Pediatric Orthopedic and Neurosurgical Spine at Nicklaus Children’s Hospital Center for Spinal Disorders, Chief of the Division of Spine at NYU Langone Medical Center, and co-founder of both SpineCore and K2M, he has built a strong relationship with the FDA, serving as a FDA consultant to companies including Howmedia and Pfizer, a patent litigation consultant to Globus Medical, and a product development consultant to Stryker Corporation. He has developed over 150 patents. |

| · | Dr. Patterson is renowned virologist pathologist and founder and Chief Executive Officer of leading biotechnology molecular diagnostics company IncellDx, having pioneered technologies that have led to advances in detection, prognosis, and treatment of patients infected with HIV, HPV, cervical cancer, COVID-19, and other diseases. Dr. Patterson has also created companion diagnostics for FDA clinical trials run by Merck, Pfizer, and others, and has 91 issued and pending patents worldwide. |

| · | Dr. Staats is one of the world’s foremost pain management doctors, having served as the youngest major division chief in the history of Johns Hopkins Hospital and was the first anesthesiologist to obtain surgical privileges at any academic university in the United States. Dr. Staats has a long track record of working with the FDA, having served as the co-principal investigator on the largest randomized controlled trial ever performed on intrathecal pumps, and principal investigator on the first large scale trial on a novel intrathecal agent for pain. His patents have led to the use of novel pharmacologic agents, including Qutenza, Prialt, and Gammacore. Dr. Staats serves as a Medical Advisor to Survivor Corps, a Covid-19 Long Haulers Support organization. |

| · | Mr. Rosenbaum has over four decades of experience in the financial and scientific communities, Co-Founder and Chief Executive Officer of SWR Corporation, which designs, sells, and markets specialty industrial chemicals, and as Chief Executive Officer and Chairman of the Board of Directors of global media measurement and research company Rentrak Corporation. His extensive experience in financial services and executive leadership, as well as prior director experience, will make him a valuable addition to the Board, and a compelling complement to the medical skill sets of our other nominees. |

| · | Ms. Yeager is an expert in pharmaceutical, medical device, and biotechnology regulatory affairs. She currently serves as Senior Vice President of Jaguar Health and Principal for Regulatory Consulting Group, a regulatory affairs and compliance consultant for development-stage biopharmaceutical companies. In both roles, Ms. Yeager develops and reviews technical, preclinical, and clinical data for regulatory submission to both U.S. and international agencies, and also serves as a regulatory and compliance liaison to global agencies. Her unique relationship with the FDA, in particular, makes her an invaluable addition to our slate of nominees. |

DESPITE WHAT CURRENT MANAGEMENT TELLS YOU, WE URGE YOU TO VOTE THE “WHITE” PROXY CARD “FOR ALL” OF THE GROUP’S NOMINEES

Finally, let us state in no uncertain terms: our group is solely focused on maximizing stockholder value by obtaining regulatory approval of Leronlimab. We are not interested in financial engineering such as a reverse stock split, a merger, a declaration of bankruptcy, or dissolution of your shares. It would be foolish to short-change the potential value of the company through “fast money schemes” as our success could significantly benefit all stockholders and their families.

Current management will tell you not to vote because they don’t want you to have the opportunity to express your dissatisfaction with their performance. But it is clear that the value of your investment is at risk. Help us enable CYDY to achieve its incredible potential by voting the WHITE proxy card to elect our five independent director nominees today.

To view our proxy statement and other information about our campaign, please visit https://www.advancingll.com. If you have any questions or require any assistance with voting the WHITE proxy card, please contact our information agent, Okapi Partners, at info@okapipartners.com or (844) 202-7428.

Yours Truly,

The Nominating Stockholders

Paul A. Rosenbaum

Arthur Wilmes

Jeffrey Beaty

Exhibit 2—Press Release Dated September 2, 2021

GROUP OF CYTODYN STOCKHOLDERS warns stockholders of board’s continued value destruction and failures

Board and Management Team Have Initiated a Misguided, Deceptive Public Relations Campaign That Has Further Damaged Company’s Value and Credibility

Urges Stockholders to Vote on the WHITE Proxy Card Today to Elect Group’s Five Highly Experienced Director Nominees to Effect Sorely Needed Change and Begin to Generate Much-Needed Revenue

NEW YORK — September 2, 2021 — A group of long-time stockholders (the “Group”) of CytoDyn Inc. (“CYDY” or the “Company”) (OTC: CYDY) that has nominated five highly experienced director candidates to serve on the Company’s Board of Directors today released a letter to fellow stockholders outlining recent ill-advised actions and announcements made by CYDY’s current leadership that have further destroyed the Company’s value and damaged its credibility.

The letter outlines CYDY leadership’s previous unwillingness to work collaboratively and constructively with experts to secure FDA approval for Leronlimab, and their greater concern with clinging to their positions and outsized compensation packages at the expense of shareholders. It also highlights the recent value destructive public relations campaign initiated by current Board and management, designed to distract stockholders from its history of failures and missed deadlines, which has only further impeded CYDY’s efforts to secure FDA approval for Leronlimab.

The letter emphasizes that if elected, the Group’s nominees will work collaboratively with others to implement a strategic plan designed to obtain FDA approval. This plan, which will be shared with all stockholders shortly, should generate much-needed revenue in the near term, help restore CYDY’s credibility, and enhance long-term value for all stockholders.

The full text of the Group’s letter to CYDY stockholders can be accessed at: www.advancingll.com/lettertwo.

All CYDY shareholders are reminded that your vote is extremely important, no matter how many shares you own and despite CYDY leadership’s efforts to suppress your vote. The value of your investment is at risk. Help enable CYDY to achieve its incredible potential by voting the WHITE proxy card to elect our five independent director nominees today.

Important Information

Paul Rosenbaum, Jeffrey Beaty, Arthur Wilmes, Thomas Errico, M.D., Bruce Patterson, M.D., Peter Staats, M.D., Melissa Yeager and CCTV Proxy Group, LLC (collectively the “Participants”) have filed a definitive proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission (the “SEC”) to be used in connection with the solicitation of proxies from the stockholders of CytoDyn Inc. (the “Company”). All stockholders are advised to read the definitive proxy statement and other documents related to the solicitation of proxies. The definitive proxy statement and an accompanying proxy card is available at no charge on the SEC’s website at http://www.sec.gov/. In addition, the Participants will provide copies of the proxy statement, without charge, upon request. Requests for copies should be directed to the Participants’ Proxy Solicitor, Okapi Partners LLC, by calling (844) 202-7428.

Disclaimer

This material does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein in any jurisdiction to any person. In addition, the discussions and opinions in this press release and the material contained herein are for general information only and are not intended to provide investment advice. All statements contained in this press release that are not clearly historical in nature or that depend on future events are “forward-looking statements,” which are not guarantees of future performance or results, and the words “anticipate,” “believe,” “expect,” “may,” “could,” and similar expressions are generally intended to identify forward-looking statements. Forward looking statements contained in this release are based on current expectations, speak only as of the date of this press release and involve risks that may cause the actual results to be materially different. Certain information included in this material is based on data obtained from sources considered to be reliable. No representation is made with respect to the accuracy or completeness of such data. The Participants disclaim any obligation to update the information herein and reserve the right to change any of their opinions expressed herein at any time as it deems appropriate.

Contacts:

Media

Mark Semer/Sam Cohen

Gasthalter & Co.

(212) 257-4170

cydy@gasthalter.com

Investors

Bruce Goldfarb/Chuck Garske

Okapi Partners

(212) 297-0720

info@okapipartners.com

Exhibit 3—E-mail to Stockholders